The transition to climate neutrality is bringing about profound changes in an energy system increasingly dominated by renewable resources. The non-manageable nature of these resources and increasing surplus generation necessitate solutions that ensure electrical supply and system reliability while also positively impacting the plant’s profitability.

The complementarity of primary resources, storage or hydrogen production are tools that allow us to turn our renewable plant into a hybrid plant. But how do I efficiently size these assets? What operational strategy do I implement to maximize my economic returns? Am I participating in the energy markets that bring me the greatest benefit? And if I sign a PPA, what price ranges are acceptable for negotiation?

To address these inquiries (and more), at Tecnatom, we offer the financial modelling solution OptimHyzer. OptimHyzer incorporates algorithms and logic that simulate the energy and economic processes of generation assets (such as solar photovoltaic, wind), storage (lithium-ion batteries) and hydrogen production. Our solution encompasses the entire hydrogen value chain, including the compression, storage and transportation stages.

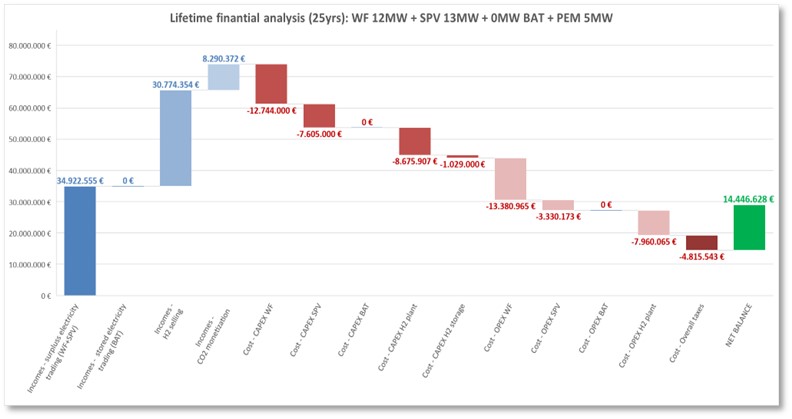

The outcomes generated by executing the algorithms align with specific predefined objectives, such as maximizing the Internal Rate of Return (IRR), calculating the break-even point and potential subsidies, or determining the optimal investment timing and the scenarios under which it occurs.

OptimHyzer also facilitates sensitivity analyses, such as assessing the impact of decreasing asset costs or the effect of electricity process if the energy mix outlined in the PNIEC (National Integrated Energy and Climate Plan) is achieved.

If you believe OptimHyzer could address your challenges, feel free to reach out to us to learn more about our optimization tool.